In the initial quarter of 2024, India witnessed a sustained high demand for smartphones, with four out of the top five vendors reporting year-on-year growth.

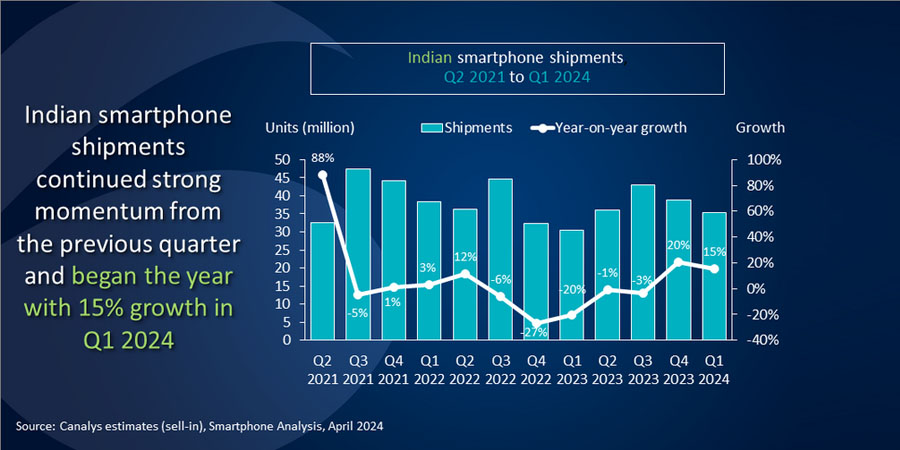

This uptick was driven by aggressive pricing strategies employed for premium models. According to data from Canalys, shipments increased by 15%, reaching a total of 35.3 million units.

According to Sanyam Chaurasia, a Senior Analyst at Canalys, most smartphone brands experienced double-digit growth, but those outside the top five continued to challenge the market dominance of leading vendors. He predicts that operational pressures arising from increased component costs will lead to further price hikes. Chaurasia also mentioned that brands will seek to justify these price increases by highlighting additional features beyond 5G capabilities.

“[The] emphasis on localization in the Indian smartphone ecosystem has become inevitable,” said Chaurasia. “While in 2024 growth catalysts seem to be limited to just 5G device upgrades and premiumization, vendors must focus on long-term strategies for share sustainability. Amid the government localization push, vendors must further focus on restructuring local distribution, leveraging local manufacturing partners and appointing Indian leadership. Additionally, they need to prioritize enhancing user experience and educating consumers for effective device engagement. Expanding into smaller cities, bolstering mainline retail, and building channel confidence will be crucial.”

Samsung maintained its leadership position in Q1 2024, with a 19% share and 6.7 million units shipped. Xiaomi received the second position, shipping 6.4 million units, thanks to its ongoing mass-market 5G strategy. Vivo ranked third, with 6.2 million units shipped. realme's share price rose to 10% after growing by 17% to 3.4 million. Overall, India shipments in Q4 2023 increased by 20% to 38.9 million units.