India’s smartphone market declined by 16% year on year in the first quarter, reaching 31 million smartphones, according to the International Data Corporation’s (IDC) Worldwide Quarterly Mobile Phone Tracker preliminary data. This marks the lowest first-quarter shipments in four years. Consumer demand remained sluggish amid uncertain macroeconomic conditions, and inventory levels were elevated because of high stocking in 2H22.

The ASP (average selling price) reached an all-time high of US$265 and the share of higher-priced smartphones (US$600+) increased to 11% compared to 4% a year ago. 5G smartphone share increased to 45%, up from 31% in 1Q22, led by Samsung, which accounted for more than a quarter of the 5G smartphone shipments.

“5G smartphones continue to increase penetration in the low-end price segment, and we should expect a strong 5G play in the US$150<US$300 segment in 2H23 as high-end 4G models vacate the space,” announced Joshi, research manager, client devices, IDC India.

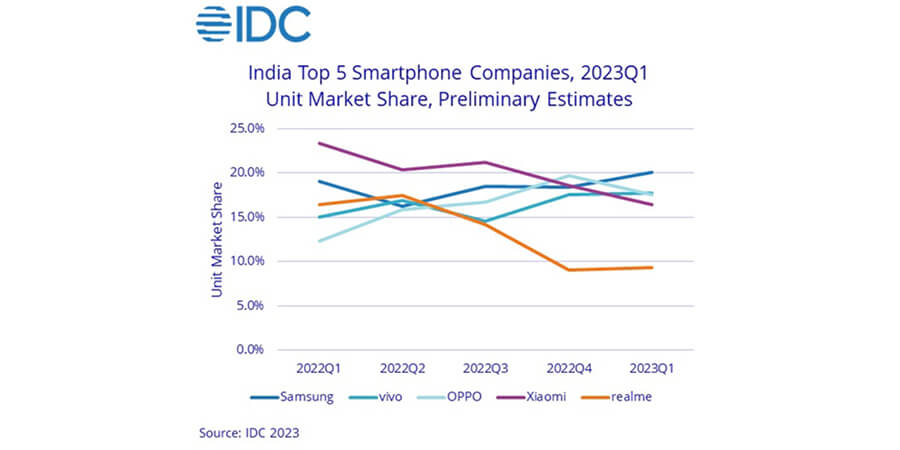

Shipments to online channels dropped significantly as offline channels were backed by new model launches and attractive channel promotions in 1Q23. Samsung climbed to the top slot after more than five years, supported by the launch of affordable 5G smartphones and the Galaxy S23 series, followed by vivo, which continued to build on its omnichannel portfolio, and OPPO (including OnePlus), while Xiaomi slipped to the fourth slot in 1Q23.

India’s smartphone market is expected to see flat growth in 2023.

“The second half of the year can bring some growth if brands bring attractive festive offerings across the channels to drive affordability. This can be facilitated by consumer optimism on the back of Cricket World Cup, a few key state elections, followed by Union elections in 2024,” said Navkendar Singh, associate vice president, devices research, IDC.