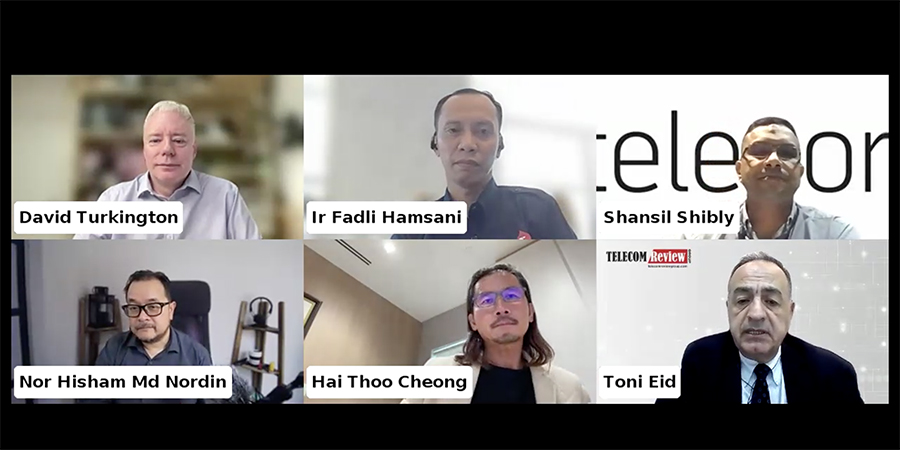

During Mobile World Congress (MWC 2024), Toni Eid, Founder of Telecom Review Group and CEO of Trace Media International, engaged in an exclusive discourse with Saleem Alblooshi, CTO of du, and Eric Zhao, Vice President and CMO of Huawei Wireless Solution to share their perspectives on the progress of the 5G industry, particularly the commercial launch of 5G-Advanced (5G-A or 5.5G).

Introducing the topic, Eid mentioned how the 5G industry is moving forward at an unprecedented speed. “The 5G connection reached 640 million in 2023, and it will grow to 10 billion as forecasted. The more exciting news is that the commercialization of 5G-Advanced was launched, especially in the UAE.”

Notably, du announced the launch of its commercial 5G-Advanced network in February 2024, and published its 5G-Advanced strategy together with Huawei.

du’s 5G History and Progress

According to Alblooshi, du started its ‘5G Leading’ strategy in 2019, and due to their cumulative efforts over the years, they now offer telecommunications coverage across the entire UAE. “We are providing 5G service to 98.5% of the population. In 2023, we [achieved] a historically high 5G benchmark, conducted by several neutral parties.”

Based in Dubai, UAE - a city filled with the highest building, the biggest shopping mall, the biggest indoor snow-park, the most luxury hotel, and the widest highways - the du CTO affirmed their objective of providing the best experience to consumers, businesses, visitors, and other end users, as the top telecom service provider in the UAE.

Huawei: Leading 5G-Advanced with Innovative Solutions

Huawei recognizes the transformative power of evolving wireless networks for mobile users, offering enhanced convenience, superior network experiences, and innovative service possibilities. Introducing 5.5G, (boasting up to 10 times faster uplink and downlink rates compared to 5G) alongside cutting-edge features like passive IoT and endogenous intelligence unlocks new business avenues.

“Operators around the world have varied spectrum conditions and service requirements, but all roads can lead to 5.5G,” Zhao declared. “For example, carrier aggregation can be performed on the existing sub-6 GHz large-bandwidth spectrum to quickly deliver a downlink peak rate of 5 Gbps.”

Zhao emphasized that despite diverse spectrum conditions and service demands globally, 5.5G presents opportunities for all operators. For instance, du has pioneered the establishment of a large-bandwidth 3CC TDD commercial network, achieving a 5 Gbps download rate. Zhao explained that leveraging spectrum like mmWave can further enhance rates, providing 10 Gbps in the downlink and expanding service scenarios. Huawei's comprehensive 5.5G GigaGreen solution portfolio, comprising ‘Native Giga,’ ‘Native Green,’ and ‘Native Intelligence,’ supports du and operators worldwide in their journey towards 5.5G.

As the leading vendor within the 5G-Advanced Industry, Zhao expressed his enthusiasm regarding their collaboration with du. He stated, “Our cooperation goes deeper in 5.5G, with milestones realized one after another.”

du Emphasizes Clear 5G-Advanced Business Case

Sharing his optimistic outlook, Alblooshi emphasized that, “In the coming years, we are going to embrace 5G-Advanced to extremely increase our customer’s experience.” du’s 5G-Advanced investment is mainly driven by their fixed wireless access (FWA) business. As per the telco’s 2023 financial report, “home broadband users grew 12.6%, meeting 600K users; it is another historical high,” described Alblooshi.

Despite du's lower fiber penetration rate compared to its competitors, the company introduced the FWA business in 2021, resulting in a doubling of user numbers by 2023. Simultaneously, the overall utilization of du's network exceeded 25%, with hundreds of sites achieving over 80% utilization.

“By launching a 5G-Advanced network, we can provide uncompromised, better experiences to customers while the traffic keeps growing,” added Alblooshi, further stating that through “the FWA business, we can also explore new use cases, such as guaranteed experience, RedCap features, Passive IoT, and other capabilities.”

5G-Advanced Has Progressed from Vision to Reality

Commenting on the standards and overall ecosystem of 5G-Advanced, Zhao outlined that, “After three years of efforts, 5.5G has progressed from vision to reality, and all of the standards, services, products, terminals, business, and policies are ready.”

Zhao emphasized that the impending release of 3GPP Release 18 in the first half of the year marks a significant milestone, while the expansion of connectivity across people, homes, things, industries, and vehicles continues to push boundaries. Terminal technologies like 3CC terminals and RedCap terminal modules are advancing, accompanied by diverse business models supporting uplink and latency capabilities monetization.

Additionally, Zhao mentioned that numerous countries are issuing supportive policies for the development of 5.5G. Globally, 5.5G commercialization is rapidly progressing, with over 10 operators launching commercial plans and over 30 conducting technical verifications. In the Middle East, operators like du are spearheading large-scale 5.5G commercialization, while operators in Europe, the Asia Pacific, and Latin America are gearing up for commercial use in 2024 by actively verifying the 10 Gbps capability.

Joint Innovation for Building Digital UAE

Alblooshi confirmed that following five years of development, the 5G capabilities in mobile and FWA are much clearer now. However, it is imperative to think bigger and consider how to facilitate the digitalization of industries. “At du, we call it Beyond Core Revenue. We had one strategy named ‘ENABLE’ and we updated it to ‘RENABLE’, aiming to create more streams, which will help operators monetize the network,” expounded Alblooshi.

Bearing this in mind, telcos such as du and leading vendors like Huawei should work together to address matters including but not limited to the following: opening network APIs to different industries, bundling the network and cloud together to provide differentiated services, improving the manufacturing industry with 5G-Advanced, and converging FWA and FTTH for better value and services.

Zhao concurred, stating that these "big topics" warrant "one dedicated study,” each to ensure efficient evaluation and response. “As the strategic partner of du, Huawei will continually stand together with du to answer these topics,” he indicated.

The Huawei executive revealed that they are introducing [5G-Advanced] use cases implemented in China to du, and that in the future they, “wish to have further cooperation with du to build a Digital UAE together.”

The fruitful discussion concluded with the endorsement of encouraging actions, as both du and Huawei proceed to jointly explore further possibilities in the 5G-Advanced era.