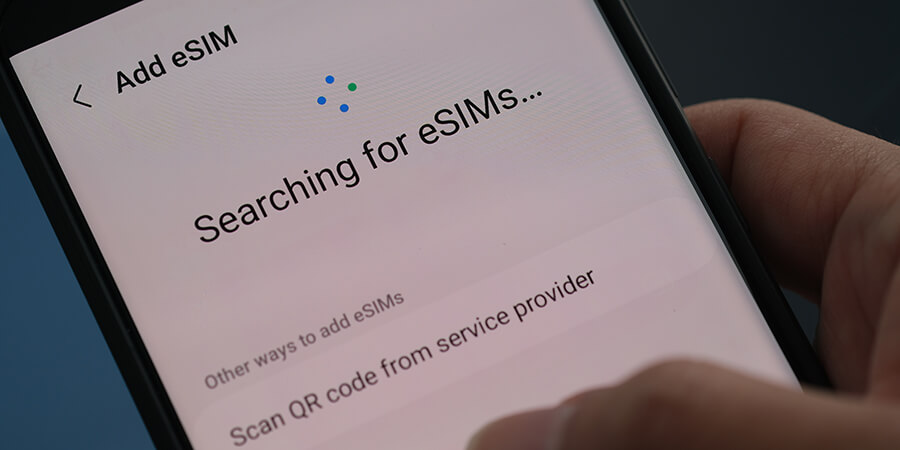

The introduction of embedded SIM (eSIM) technology has transformed global travel, leading to a significant increase in the number of eSIM users from 40 million in 2024 to over 215 million by 2028.

Travel eSIMs offer an alternative to traditional roaming services provided by operators. They allow travelers to download a temporary local profile onto their device, enabling them to avoid expensive roaming charges.

A recent study conducted by Juniper Research, a leading authority in telecommunications markets, revealed that the global number of travel eSIM users is expected to soar by approximately 437.5% by 2028.

Factors Driving eSIM Adoption

The Juniper Research study suggests that the growing cost of international roaming will drive the adoption of travel eSIM packages. In 2024, mobile subscribers are projected to spend an average of USD 8.57 per GB of data while roaming, whereas travel eSIM users will only spend USD 5.50 per GB. This represents a 35% cost reduction, making travel eSIMs a compelling option for international travelers.

The study also highlights the benefits for travel eSIM vendors. With the increasing availability of eSIM-capable devices in many countries, there is a significant opportunity for user growth. For instance, more than half of connected devices in the US are expected to have eSIMs installed by 2024, creating a sizable market for travel eSIMs.

Furthermore, eSIM technology aligns with the growing emphasis on environmental sustainability and reducing electronic waste. Traditional SIM cards are typically made from plastic and require manufacturing, packaging, and shipping processes, which contribute to carbon emissions and environmental degradation. In contrast, eSIMs eliminates the need for physical SIM cards, reducing the consumption of plastic and the associated environmental footprint. Moreover, eSIMs promote device longevity by enabling remote SIM provisioning and updates, reducing the need for device replacements due to SIM-related issues.

Optimizing Distribution Channels

According to extensive research findings, the key to driving the growth of travel eSIM package sales lies in the strategic optimization of distribution channels and the facilitation of a seamless purchasing journey for consumers. By leveraging a multitude of effective distribution channels, such as online platforms, retail outlets, and partnerships with travel agencies, eSIM providers can significantly enhance their market reach and accessibility to potential customers.

Moreover, focusing on creating a seamless purchasing experience for consumers is paramount. This entails streamlining the process of acquiring and activating eSIM packages, ensuring user-friendly interfaces, and providing comprehensive customer support. By prioritizing these aspects, eSIM providers can effectively cater to the evolving needs and preferences of travelers, thereby fostering increased adoption and sustained growth in the travel eSIM market.

However, as the popularity of travel eSIM solutions rises, the study predicts that operators could lose over USD 11 billion globally to travel eSIMs. To counter this threat, the study recommends that operators develop and implement their own travel eSIM solutions to complement their existing roaming packages.